marin county property tax due dates 2021

September 28 2021 at 411 pm. Online or phone payments recommended by Tax Collector.

Property Tax Bills On Their Way

Secured property taxes are payable in two 2 installments which are due November 1 and February 1.

. Local Business Tax Receipts become delinquent October 1st. The Marin County Department of Finance has mailed out 91854 property tax bills for. For questions about property tax.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at.

The second installment must be paid by April 10 2021. Secured property tax bills are mailed only once in October. Lien Date - 1201 am.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Service members deployed outside of the United States may be allowed an extension for payment of Real Estate and Vehicle Car. April 01 2022 Second Installment of Property.

Property Tax Bill Information and Due Dates. The time when the taxes become a lien on property and the time property. Please retain the payment confirmation number.

A A A A. Mina Martinovich Marins interim director of finance said the. And late fee applies.

Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 352 368-8200. Property tax bills are mailed annually in late September and are payable in. San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm.

The Marin County Department of Finance has mailed out 91854 property tax bills for. On April 9 and 8 am. Marion County Tax Collector.

MARIN COUNTY CA Marin Countys 2020-21 property tax bills have been sent to property owners. September 27 2021 at 642 pm. On January 1 preceding the fiscal year for which property taxes are collected.

The hours for the Tax Collectors office and express payment drop box are 9 am. If you have questions about the following information. Local Business Tax Receipt renewals due by September 30th.

The hours for the Tax Collectors office and express payment drop box are 9 am. MARIN COUNTY CA Marin. Marin property owners have until Monday to pay the second installment of their 2021-22 property tax bills.

Marin County taxpayers are being asked to pay. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm. On April 9 and 8 am.

Ad Find Marin County Online Property Taxes Info From 2021. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board.

Roy Given Department of Finance. Tax bills are mailed approximately 30 days prior to the payment due date. For all due dates if the date falls on a Saturday Sunday or County holiday the due date is extended to the following business day.

The tax year runs from January 1st to December 31st. Not County of Marin. If you are a person with a disability and require an accommodation to participate in a.

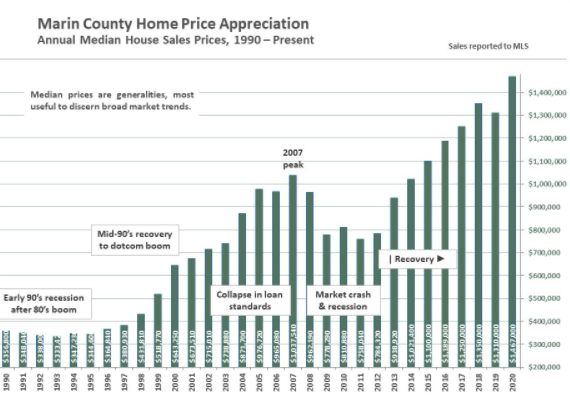

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. For questions about property tax billing contact the.

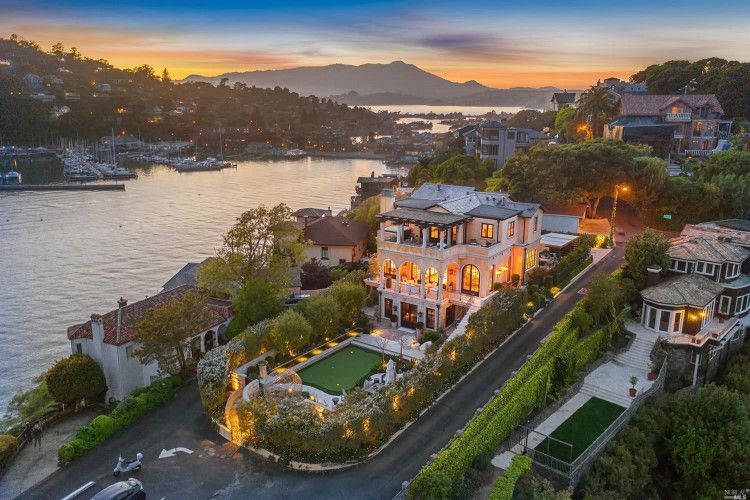

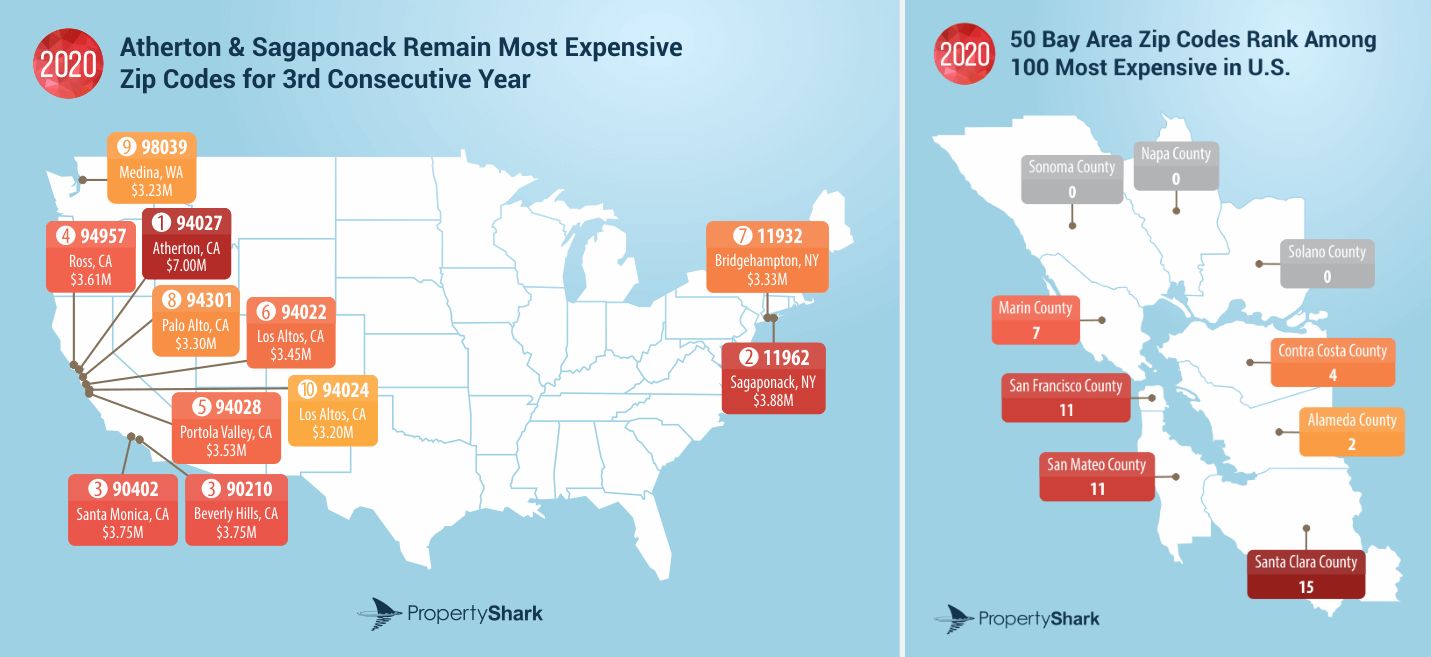

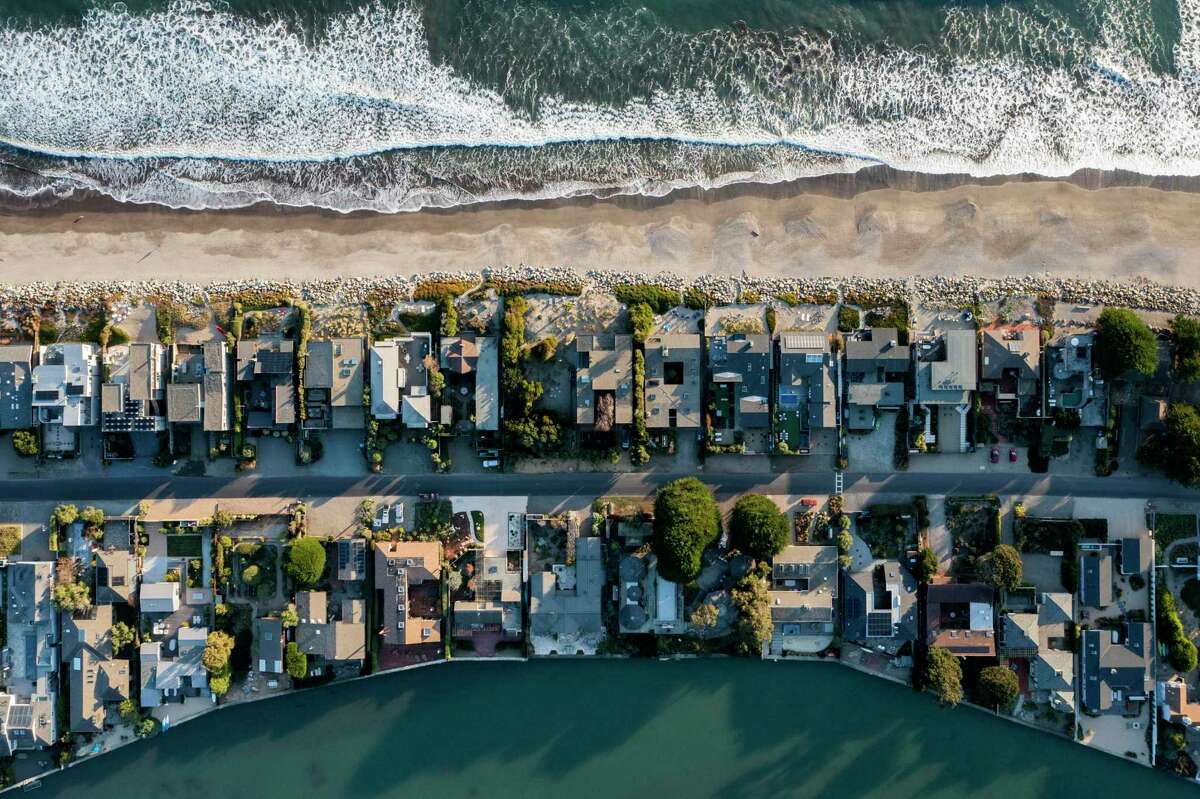

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Marin County Office Of Education Homepage

Marin County Mails Property Tax Bills Seeking 1 26b

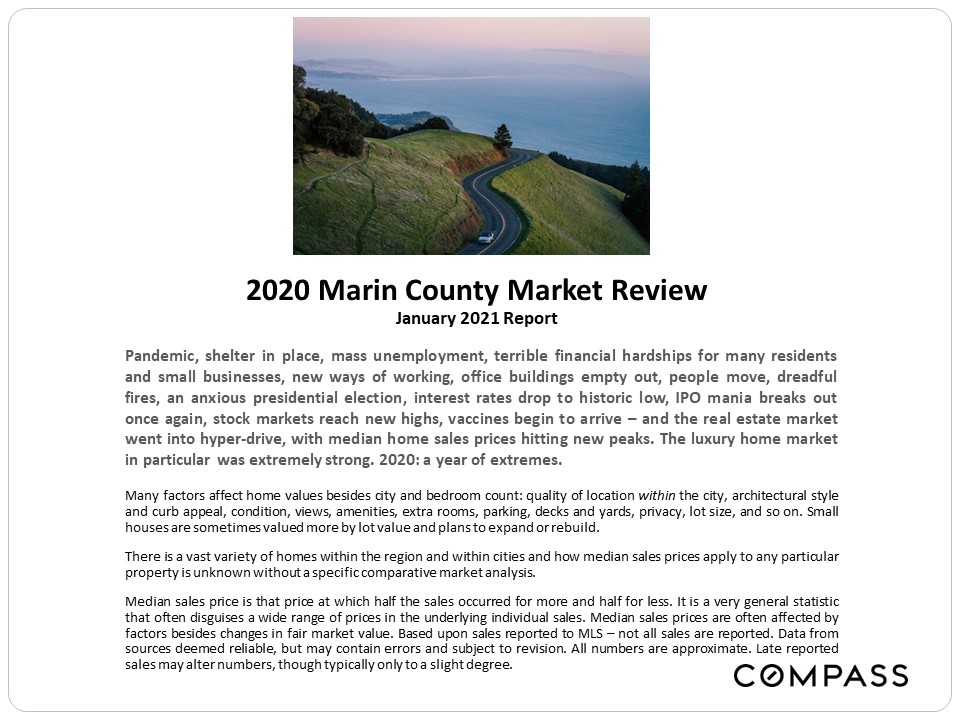

Marin County Real Estate Report January 2021 Carey Hagglund Condy Luxury Marin Homes

Password Change Instructions Password Change Instructions

Class Specifications County Of Marin Careers

Marin County Property Tax Due December 12 Marin County Real Estate Blog

Marin County Real Estate Report January 2021 Carey Hagglund Condy Luxury Marin Homes

Property Tax Bills On Their Way

Marin Extends Moratorium On West Marin Short Term Rentals

Faqs Assessor Recorder County Clerk County Of Marin

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop 19 Rules Higher Taxes

Stinson Beach Bolinas Could Be Impacted If Marin County Temporarily Bans Short Term Rentals

When Are Marin County Property Tax Bills Due

College And Career Readiness Rop Courses

Property Taxes Due Dec 10 In Marin County San Rafael Ca Patch

Marin County Ford Ford Dealer In Novato Ca

Cutting The Cord In Marin County Complete Guide To Dumping Cable Tv

Marin Public Health Vaccine Pop Up Site At Margaret Todd Senior Center Citas Para Vacunacion Estan Disponibles En Estacionamiento Del Margaret Todd News City Of Novato Ca